QuickBooks is the middle ground of the apps in this post; it’s not quite as beginner-friendly as FreshBooks, but once you watch a few of the help videos it’s easy to get started thanks to the service’s slick design. The only real issue with Quickbooks is that the sheer spread of features can be a little overwhelming at first, and learning how to fully use the app can be difficult. Finally, if you’re looking for an even simpler solution to solely create your invoices, you’re probably better creating your own invoice generator than signing up and paying for a FreshBooks plan. It’s a fantastic piece of kit, but even this can be too complicated for some peoples’ needs.

Plus, there are fewer features, such as inventory management, which can confuse users new to QuickBooks. That being said, if a small business does need all the bells and whistles that QuickBooks offers, they’ll have to take the time to learn the program and master its features. Intuit QuickBooks is a popular accounting software program that has been around for years. It’s beloved by many small business owners for its comprehensive features and its ability to integrate with pretty much anything out there. FreshBooks, on the other hand, hasn’t traditionally been as popular because it focuses on the much smaller end of the business market.

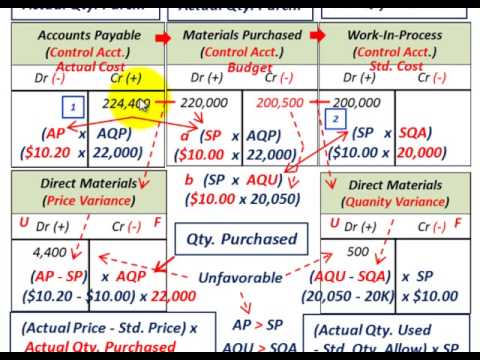

- For more advanced features, such as accounts payable and accountant access, you’ll need to upgrade to a higher plan.

- It’s expected that accountants have recommendations when choosing your cloud accounting tool.

- FreshBooks doesn’t offer built-in payroll features and requires integration with Gusto for payroll services, which may involve additional costs.

- Let’s dive into the specifics of the two to see where each software shines.

FreshBooks customer service

Zoho Books is the accounting software provided by the office suite platform Zoho. It’s an easy-to-use platform that naturally integrates with other Zoho programs. For transaction account new and small businesses that don’t need to assign many users, the Free platform is quite robust. Users can customize invoices, manage 1099 contractors and schedule reports to be automatically produced on regular cycles. Intuit QuickBooks is arguably the most well-known and widely used online accounting software. It has helped small businesses for nearly four decades to keep track of their line items and accounts payable.

Both made our list of top QuickBooks alternatives, meaning they’re functional, powerful and easy to use. To know which might be right for your needs, check out our FreshBooks vs. Xero comparison. FreshBooks is great for very difference between accrual and deferral small businesses who just want a quick and easy way to deal with their invoicing. It’s not a full accounting suite, but its pricing and ease of use make it great for serving as a quick and easy solution. Here’s where the difference between QuickBooks and Xero becomes clear. Instead of limiting the features you have access to on cheaper plans, Xero is a little more expensive in general but focuses on limiting the number of employees you can have on payroll.

User reviews

Back in September of 2016, FreshBooks made the bold decision to start from scratch and redesign its service, and both versions of the app are currently available. While the new version is infinitely better in terms of being easier to use (more on that later) and a better user experience overall, there are still a few visual bugs which can be confusing. FreshBooks – with its slick design and thorough tutorials, FreshBooks is perfect for small businesses looking to organize everything to do with their invoices. Deciding between FreshBooks and QuickBooks depends on how big your business is now and how big it will get.

With more than 3 million users worldwide, Xero is popular but not as ubiquitous as QuickBooks Online. Xero is also gearing up to launch Just Ask Xero (JAX), a generative AI assistant designed to help businesses complete accounting tasks like creating invoices or paying bills. While details on pricing and a hard launch date are still under wraps, JAX promises to reduce admin time by giving users a more intuitive, hands-free way to manage their finances. In addition to its more robust reports, Xero proves itself to be the better fit for established and growing organizations with its bank reconciliation feature. Least expensive plan lacks double-entry accounting reports, bank reconciliation and accountant access. Another option is Wave, which is a free accounting software program that includes invoicing, payroll, double-entry and sales tax tracking.

Add or update Mailchimp subscribers for new clients in FreshBooks New

QuickBooks is a popular accounting software used by small businesses, solopreneurs and freelancers. The software helps users to keep track of their finances, customers and vendors. Plans start at $15 per month for up to 20 invoices, five bills, bank account reconciliation, receipt capture and short-term cash flow snapshots. Its $78-per-month plan also includes multiple currencies, project tracking, in-depth analytics and employee expense claims. QuickBooks is available both online and via desktop and is ideal for businesses that outsource their accounting tasks to a bookkeeper or accountant. This is because QuickBooks only allows up to 40 users for its highest-tiered plan, and even then, some plans require every user to pay for their own account.

Every feature works logically and avoids drowning you in extensive dropdown menus, although this could admittedly be due to the smaller number of features available. While QuickBooks does offer a more scaled-back product for freelancers and gig workers — QuickBooks Solopreneur starts at $20 per month — you can’t seamlessly grow into QuickBooks from this version. While QuickBooks has many different accounting products, QuickBooks Online is most comparable to FreshBooks. When we mention QuickBooks in this comparison, we’re referring specifically to QuickBooks Online. Saved payment information can always be removed if you want to opt-out of Recurring Payments at any time. One thing about Xero – when you have a question their first response is to tell you to have your accountant look at it.

QuickBooks is more comprehensive but also requires more training to maximize the use of features. FreshBooks is best for small companies with users who don’t have a lot of experience in comprehensive accounting principles. As FreshBooks states, this is to “simplify everything from payment to payroll.” You can integrate popular apps such as Indeed, Acuity Scheduling and NiceJob. For example, integrating with NiceJob can automate FreshBooks to solicit and capture reviews and referrals from your existing client base. Includes tools that help automate the reconciliation process, along with a global what will cause a change in net working capital search function and customizable dashboard; has a simple layout.

QuickBooks offers specialized tutorials to help users make the changes that work for them. Includes tools that help automate the reconciliation process, along with a global search function and customizable dashboard; however, there is a learning curve. When it comes to AI, Xero has a few tricks up its sleeve that FreshBooks currently lacks. The bank reconciliation predictions help make those tedious end-of-month tasks a little easier by using past transaction data to suggest matches for your bank statements. This saves you from repetitive clicks by automatically identifying business names and common expenses. That said, Xero makes up for its user-friendliness shortcomings through tutorial videos and a demo company feature.