With an outsourced partner managing these critical tasks, companies can prioritize their core competencies and devote more time and resources to expanding their business and reaching new heights. In the world of accounting outsourcing, compliance and data security are of utmost importance. Organizations need to adhere to various rules, regulations, and industry benchmarks when handling sensitive financial data. This section will discuss the importance of GDPR and financial data protection, as well as maintaining compliance in financial operations.

It is important to note that labor costs are often one of the 13 things bookkeepers do for small businesses highest expenses for businesses, and outsourcing can lead to substantial cost savings. No matter your entrepreneurial pursuit, “Accounting outsourcing services” is here to provide professional accounting services tailored to your specific industry and business objectives. We are your trusted partner in navigating the financial complexities, allowing you to thrive in your chosen field and focus on what you do best. With “Accounting outsourcing services” you can trust that your non-profit organization’s financial matters are in capable hands. Our dedicated team ensures that your payroll, tax, and reporting obligations are met, allowing you to concentrate on the meaningful work of making a positive impact in the community.

However, the establishment of an accounting division, hiring and training bookkeeping personnel and buying accounting software is costly. Such companies, whose core competency is not accounting and cash for invoices the pros andcons of construction factoring bookkeeping, can benefit by outsourcing to professional accounting firm. At “Accounting outsourcing services” we extend our specialized accounting services to non-profit organizations, including charitable foundations and public organizations. Yes, virtual and outsourced bookkeeping is just as legitimate as in-house bookkeeping and accounting. However, as with any in-person accounting professionals you’d trust with your financial data, you should always verify a bookkeeping firm’s credentials before committing to a monthly plan.

Saves time

Our team is ready to learn about your business and guide you to the right solution. Want to learn more about bookkeeping before you sign up for a virtual provider? Our article on business bookkeeping basics gives you more information on how to do bookkeeping and why.

Top trends in finance and accounting outsourcing

As you grow, having a professional, outsourced accountant on your side gives you the advantage of proactivity rather than reactivity. Trained accountants can spot red flags ahead of time and notify you about things like cash flow discrepancies. It’s dead-simple to use and makes those intimidating tasks feel relatively straightforward. You can manage all your payroll and HR benefits from the Gusto platform, and if you ever have questions, you can ask one of their payroll specialists. With Bench’s Catch Up Bookkeeping services, a Bench bookkeeper will work through past months of disorganized bookkeeping to bring your accounts up to date.

- At “Accounting outsourcing services” we extend our specialized accounting services to non-profit organizations, including charitable foundations and public organizations.

- Units Consulting Ltd. (Ukraine) provides professional multi-lingual accounting and payroll services (English, Ukrainian, Russian) to the companies, foreign representative offices and NGOs that operate various businesses.

- In the world of accounting outsourcing, compliance and data security are of utmost importance.

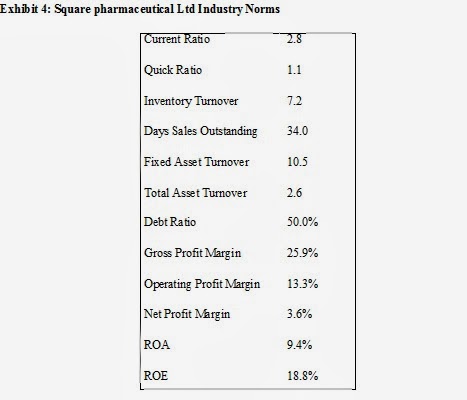

- Nevertheless, these data are truly useful to management and investors of the company in case of their relevance, objectivity and completeness of the indicators reflect business activity.

The Philippines is among the world’s leading outsourcing destinations and not just because clients can save up to 70% on labor costs. The labor pool in the Philippines is known for its tech competency, attention to detail and operates in a fiscal and third parties and assignments – contracts financial system almost identical to conditions in the West. In fact, the Philippines is one of the most dynamic economies in the East Asia region3, with sound economic fundamentals and a globally recognized competitive workforce. In this blog we delve into the intricacies of outsourcing, uncovering strategies, best practices and key considerations to help you harness its full potential and propel your business toward sustainable growth and success.

From cost savings and access to specialized expertise to enhanced scalability and flexibility, this comprehensive guide is your roadmap to navigating the complexities of outsourcing in the realm of finance and accounting. You can outsource payroll management to an accounting firm, but it’s often easier, faster, and more cost-effective to use a global HR platform like Remote — especially if you have team members in different locations. In this article, we’ll explain what exactly outsourced accounting is, what it covers, and how it can help your company. We’ll also give you some key tips and insights into finding a provider and ensuring the process goes smoothly.

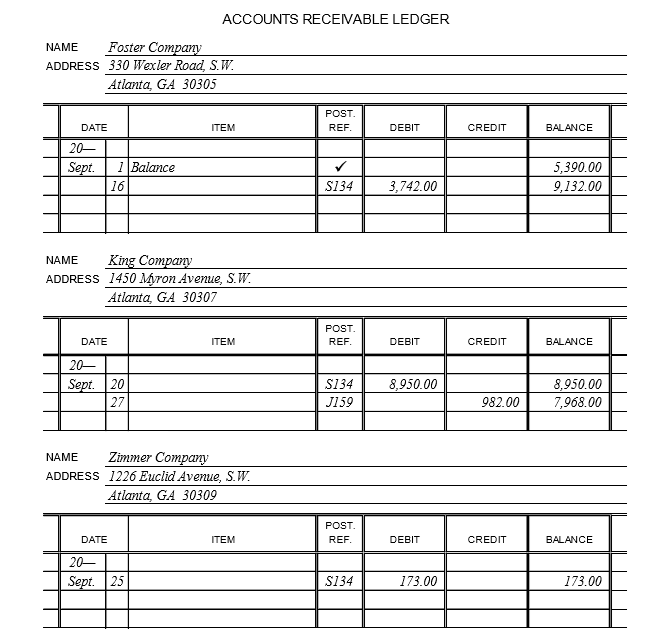

Accounts receivable and accounts payable

Units Consulting Ltd. (Ukraine) provides professional multi-lingual accounting and payroll services (English, Ukrainian, Russian) to the companies, foreign representative offices and NGOs that operate various businesses. For entrepreneurs involved in foreign economic activity, we provide comprehensive support in dealing with international transactions, currency exchange, import/export regulations, and tax considerations. Our expertise ensures that your business expands seamlessly across borders while maintaining financial accuracy and compliance.

Evaluating CPA Firms and Accounting Platforms

But there’s more than one virtual accounting company in the world, and solutions range from on-demand CFO services to simple pay-by-the-hour book balancing. Below, we review the best virtual and outsourced accounting services for small-business owners like you. With outsourced accounting services, you’ll have meticulous eyes that can process financial data while ruling out fraud simultaneously. Hiring an accountant can be a daunting task for several small businesses and startups. No matter the size of your company, you want the best set of hands to handle your financial records. Outsourcing finance and accounting functions can have a significant positive impact on a company’s efficiency.