Below, we take a look at the role that the government plays in protecting critical infrastructure. Critical Infrastructure Protection (CIP) is required to ensure the security and resilience of the vital infrastructure upon which modern society depends. You should consult with a licensed professional for advice concerning your specific situation. By focusing on both technological advancements and the irreplaceable value of human input, the accounting industry can achieve new heights of efficiency, accuracy and client satisfaction.

What is construction in progress?

- In conclusion, Viindoo is a comprehensive accounting software solution that can assist construction companies with their CIP accounting needs.

- – Construction companies must also track anomalies like job costing, retention, progress billings, change orders, and customer deposits.

- Optimize your construction project’s financial health with effective CIP accounting strategies and insights for modern multi-project environments.

- CIP accounting is important to a construction company’s accounting system software because it allows businesses to track the progress of a construction project and monitor its costs.

- Once a construction project is finished, the costs in the CIP account move to a fixed asset account.

- If the financial statements have ‘construction in progress or process’ under the head of PP&E, it is a ‘build to use’ asset.

- All the costs of assets under construction are recorded in the ‘Construction In Progress Ledger Account.’ They are shifted to the asset side of the balance sheet from the ledger.

Ultimately, including all potential sources of revenue will give you the best chance of accurately predicting the financial outcome of your construction project. Managing construction-in-progress accounts is relatively more complicated than managing other business accounts. Firstly, a construction company does double-entry bookkeeping, as it is the approved method of tracking finances in the industry.

Nature of construction in progress (CIP)

- This includes the cost of materials, labor, equipment, and any overhead expenses.

- Utilizing tools like Microsoft Power BI or Tableau can enhance these reviews by offering visual analytics and dashboards that make data easier to interpret.

- Schedule a demo of Quantum Rugged today to learn how Check Point can help your organization protect its critical infrastructure from cyber threats.

- On the other side, there are assets that may take weeks, months or event years before they are fully functional and ready for use.

- For instance, if a project is 60% complete, 60% of the total contract revenue can be recognized.

- Hiring an experienced accounting team is the best way to ensure that your company maintains accurate, detailed, and up-to-date accounting books through every step of the construction process.

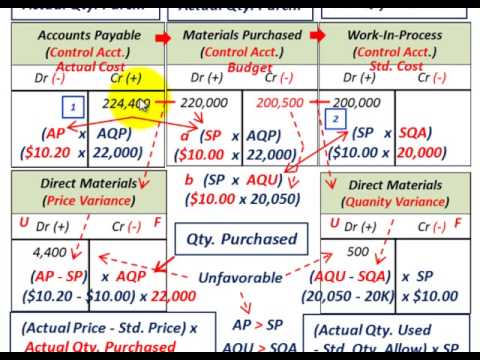

It also dictates which revenues and costs related to a construction contract should be recorded and when to record. Revenues and gross profit are recognized each period based on the construction progress, in other words, the percentage of completion. Construction-in-progress are generally not classified as inventory as it would not be in-line with IAS2.9 (Inventories to be stated at lower of cost or NRV).

Accounting for Construction-in-Progress Charges

Recognizing revenue from Construction-in-Progress (CIP) projects is a nuanced process that requires careful consideration of various accounting principles and industry standards. One widely adopted method is the percentage-of-completion approach, which allows companies to recognize revenue based on the project’s progress. This method aligns revenue recognition with the actual work completed, providing a more accurate reflection of the project’s financial status. For instance, if a project is 60% complete, 60% of the total contract revenue can be recognized. This approach not only smooths out revenue over the project’s duration but also helps in matching costs with revenues, thereby offering a clearer picture of profitability. The accounting for construction in progress for such businesses is a little bit complicated.

Construction in Progress Journal Entry

As it goes, small construction companies rarely hire experts to track and record their transactions. However, as the company expands, recruits more employees, and works simultaneously on multiple projects, tracking transactions on a spreadsheet gets difficult and time-consuming. Construction auditors must adhere to the Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) guidelines. The basics of accounting for construction companies also include revenue recognition and cost allocation. You should pre-screen CIP-related invoices when they are first entered into the system, so that items to be expensed are charged off at once. They should NOT be stored in the CIP account; otherwise, there is a considerable risk that expensable items will not actually be charged off for some time.

Journal Entry for Construction in Progress

In the following article, learn everything you need about CIP Accounting with Viindoo Enterprise Management Software. Because the expansion is complete and in service, the equipment in this example will begin depreciating as other fixed asset accounts do. Construction work-in-progress accounting refers to the record-keeping of all expenditures that accrue in constructing a non-current asset. An accountant will report spending related to the construction-in-progress account in the “property, plant, and equipment” asset section of the company’s balance sheet. During the construction, company needs to record revenue, expense and accounts receivable. However, these costs should be offset by the revenue generated from the contract.

- Recognizing revenue from claims requires a high degree of certainty that the claim will be approved and the amount can be reliably estimated.

- By keeping accurate records of expenses, businesses can ensure that projects are completed within budget and on time.

- Instead, they recognize revenue and expense by allocating it to accounting periods over the life of the project, based on how much of the project is finished.

- Rather than construction in progress, you might see construction in process on financial statements.

- A higher asset base can make a company appear more robust, but it also necessitates careful management to ensure that these assets eventually translate into revenue.

For example, Auto Parts Store builds an extra storage facility for its inventory. When the building is ready to move into, they will debit Buildings and credit Construction in Progress. In addition to knowing what construction in progress accounting is, you should also know what’s involved when recording the account. Like previously stated, the construction in progress account has a natural debit balance.

Accounting Guide for Construction Contractors

Laura Chapman holds a Bachelor of Science in accounting and has worked in accounting, bookkeeping and taxation positions since 2012. She has written content for online publication since 2007, with earlier works focusing more in education, craft/hobby, parenting, pets, and cooking. Now she focuses on careers, personal financial matters, small business concerns, accounting and taxation. Laura has worked in a wide variety of industries throughout her working life, including retail sales, logistics, merchandising, food service quick-serve and casual dining, janitorial, and more.

Construction in progress

However, you must know that the nature of costs and revenues in every construction contract varies. Therefore, the construction in progress is a non-current asset account that keeps what is cip accounting a record of all the costs incurred until completion. One thing to understand is that only capital costs related to an asset under construction are to be kept in the CIP account.

Financial Controller: Overview, Qualification, Role, and Responsibilities

Each one of these sectors is deemed necessary by Homeland Security to provide a stable standard of living for citizens of the United States, thus the “critical infrastructure” designation. While AI brings remarkable efficiencies and accuracy to accounting, the human element remains crucial. AI tools can handle repetitive tasks, but strategic thinking, ethical judgment and personalized client interactions are areas where human expertise still reigns supreme. By leveraging AI, accountants can focus more on advisory roles, providing deeper insights and more value to clients. Artificial intelligence (AI) is transforming the accounting industry at an unprecedented pace, revolutionizing traditional practices and unlocking unprecedented profits.