The above equation only works when the expected annual cash flow from the investment is the same from year to year. If the company expects an “uneven cash flow”, then that has to be taken into account. At that point, each year will need to be considered separately and then added up. If you choose this option, you can populatenet cash flows for 10 periods.

Related Calculators

We obtain the break-even point of a project when the net cash flows exceed the initial investment. The breakeven point is the price or value that an investment or project must rise to cover the initial costs or outlay. The payback period refers to how long it takes to reach that breakeven.

Calculator for Payback Period (Calculate the PbP Online

The appropriate timeframe for an investment will vary depending on the type of project or investment and the expectations of those undertaking it. This period new property tax rebate program does not account for what happens after payback occurs. Many managers and investors thus prefer to use NPV as a tool for making investment decisions.

Payback Period: Definition, Formula, and Calculation

- There are other methods used in Capital budgeting such as Net Present Value, Internal Rate of Return and Discounted Cash Flow which are currently more in vogue.

- This means it will only take 3 years for Jimmy to recoup his money.

- Forecasted future cash flows are discounted backward in time to determine a present value estimate, which is evaluated to conclude whether an investment is worthwhile.

WACC is the calculation of a firm’s cost of capital, where each category of capital, such as equity or bonds, is proportionately weighted. For more detailed cash flow analysis, WACC is usually used in place of discount rate because it is a more accurate measurement of the financial opportunity cost of investments. WACC can be used in place of discount rate for either of the calculations.

For example, if it takes five years to recover the cost of an investment, the payback period is five years. Conversely, the longer the payback, the less desirable it becomes. For example, if solar panels cost $5,000 to install and the savings are $100 each month, it would take 4.2 years to reach the payback period. The payback period is a method commonly used by investors, financial professionals, and corporations to calculate investment returns. Between mutually exclusive projects having similar return, the decision should be to invest in the project having the shortest payback period. The payback period is a major consideration for sectors that are prone to projects fast becoming outdated.

The quicker a company can recoup its initial investment, the less exposure the company has to a potential loss on the endeavor. Average cash flows represent the money going into and out of the investment. Inflows are any items that go into the investment, such as deposits, dividends, or earnings. Cash outflows include any fees or charges that are subtracted from the balance. Due to its ease of use, payback period is a common method used to express return on investments, though it is important to note it does not account for the time value of money.

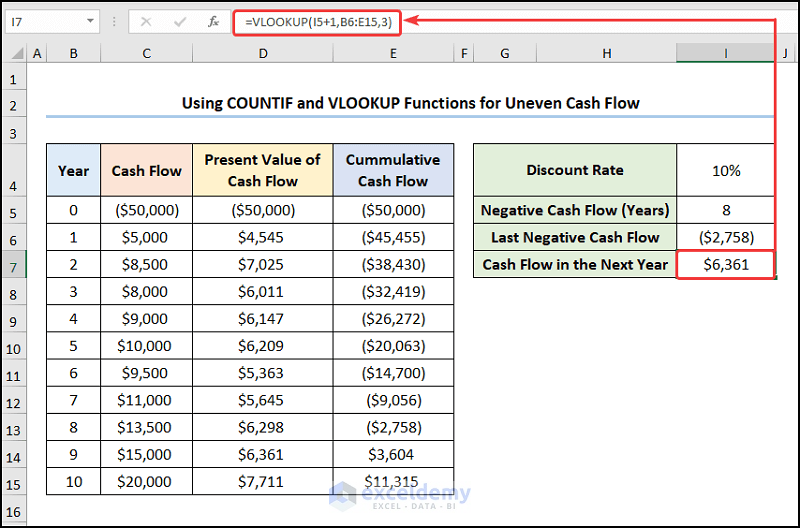

Thus, the project is deemed illiquid and the probability of there being comparatively more profitable projects with quicker recoveries of the initial outflow is far greater. Cumulative net cash flow is the sum of inflows to date, minus the initial outflow. Next, we’ll find the cash flow for the next year by using the VLOOKUP function again.

The discounted payback period determines the payback period using the time value of money. This inserts the first entry for the cumulative cash flow calculation. Depending on the number of cash flow input boxes you selected, you need to enter all cash flows. For example, for your investment, enter $500, $600, $700, $800, and $900. Or the numbers suddenly start fluctuating downwards from year 3 on?

The payback period can be defined as the amount of time required to repay the primary investment by using the cash inflows it generates. The value indicates the exact time it will take to recover initial costs, and helps to evaluate the risks of the project. The payback period is the time it will take for a business to recoup an investment.

In Excel, create a cell for the discounted rate and columns for the year, cash flows, the present value of the cash flows, and the cumulative cash flow balance. Input the known values (year, cash flows, and discount rate) in their respective cells. Use Excel’s present value formula to calculate the present value of cash flows.